The fastest way to run a Syndicate or SPV in Europe

Who it's for

Whether you're a syndicate lead, fund manager, or founder, Shuttle simplifies your investment workflow.

Syndicate leads

Run all your deals seamlessly, without lawyers or admin, via a centralised platform.

Fund managers

Create a sidecar in minutes and let your LPs invest directly, through a regulated EU structure.

Founders

Bring many investors into your round with one clean line on the cap table. Forget the admin.

Your steps to success

01

Create

Set up your deal hub once - this becomes your home for all future deals. Easily add new deals, round details, and terms.

02

Share

Share personalised invites directly from Shuttle; LPs only need to complete KYC once for all future deals.

03

Commit

Easily monitor LP engagement via your reporting dashboard. Once committed, payments and reconciliation are handled automatically.

04

Close

Wire funds in a click. Shuttle's nominee appears as a single line on the company's cap table.

05

Scale

Your AI co-pilot monitors deal health, flags at-risk investors, and handles routine follow-ups automatically, so you focus on closing, not chasing.

Why deal managers choose Shuttle

Less time on admin and coordination. More time on deals and relationships.

Efficiency & automation

Automate onboarding, investor consent, and payment collection in a single workflow. What used to take weeks now takes hours.

Compliance & trust

Directly regulated by the Central Bank of Ireland. Give your LPs confidence with institutional-grade compliance built in.

Faster closes

Close deals in days, not months. Streamlined KYC, embedded payment rails, and automated reconciliation accelerate every step.

Higher conversion

Frictionless investor experience means more commitments convert to funded investments. Less drop-off, more capital deployed.

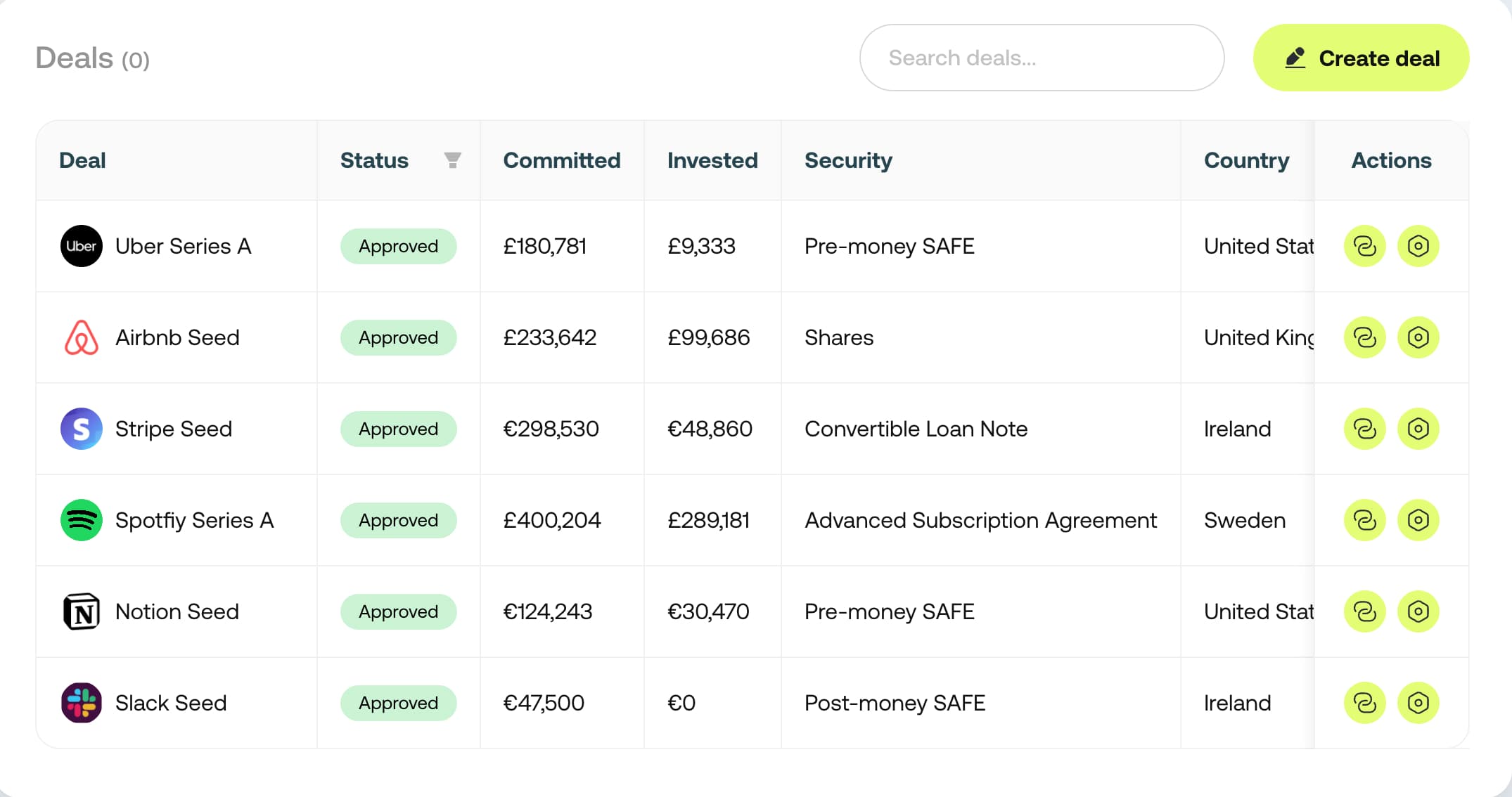

Powerful tools, simple interface

01- 03

Rich Reporting & Analytics

Real-time dashboards showing commitment progress, investor engagement, and portfolio performance. Export reports for your LPs with one click.

02- 03

Embedded Payment Infrastructure

Collect funds directly through Shuttle with integrated payment rails. Automatic reconciliation means no more chasing wires or matching payments.

03- 03

Investor Management

Centralised CRM for all your LPs across every deal. Track engagement, manage relationships, and grow your investor network over time.

Speed & ease of setup

Launch your first deal in minutes. No lawyers, no paperwork, no delays. Just create, share, and start collecting commitments.

Better investor experience

Your LPs complete KYC once and invest in seconds thereafter. A consumer-grade experience that keeps them coming back.

Lower friction for founders

Founders see one clean line on their cap table instead of dozens of individual angels. Makes future rounds simpler.

Compliance built-in

Central Bank of Ireland regulated. AML, KYC, and investor suitability handled automatically for every deal.

Seamless investor management

Track commitments, manage communications, and report to your LPs all from one centralised dashboard.

Simple, transparent pricing

Estimate your Shuttle fees

Set your target raise to see how pricing scales.

Target raise:€500,000

Tier 1First €500K at 1%

Estimated fees

€5,000

Based on tiered pricing

Pricing caps

Minimum fee: €2,000

Maximum fee: €15,000

What's included

Setup < 30 minutes

Data migration support

Unlimited investors per deal

KYC & AML compliance

Embedded payments

Portfolio reporting tools

Lifetime administration and distributions

Full exit / wind down of the deal